The short answer is PROBABLY. However, there are cases where you are not required to file, but it would be to your benefit to file. I’m sure if you’re used to getting a refund you tell yourself “taxes, what’s the big deal? I don’t pay any, I ALWAYS get a refund.” Well what you fail to understand is that refund comes from overpaying taxes and while it is great to get a check after the holidays to cover the damages for shopping for a huge family, this is money you should not have paid in the first place.

I am not advocating NOT paying your taxes, what I am saying there is you should not be paying too much. That is a topic for another post though and another great reason to schedule a FREE consultation with one of our Tax Patriots for tax planning purposes. For the purposes of this post, we want to inform you as to whether you NEED to file a return or not. For anyone who owes money it is an absolute must! While most put it off in hopes that the IRS will never catch you, they are like Elliot Ness, they always get their man and the longer you avoid filing the more you pay in late filing and late payment penalties in addition to the balance you already owe.

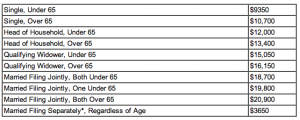

On the other hand, those who are not required to file are usually ones who will get a refund if they file and are only shooting themselves in the foot by not filing. For this year, 2011, it is the 2010 Tax Return(not 2011), here are the filing requirements, which are based on Filing Status, Age and Gross Income:

If you are ____ and your(combined- if married) income is greater than ____ you must file!(even if you’re expecting a refund)

In addition, if you are blind there is an additional “standard deduction”, which means a bonus deduction from your Adjusted Gross Income that is non-taxable. For Tax Year 2010 this “standard deduction” has stayed the same for all filing statuses except for Head of Household, where it went from $8350 to $8400.

If you are a dependent of someone else, these numbers will be different as you will not be able to claim your own “exemption”, another amount of income that is non-taxable, which for 2010 is $3650. Additionally you also need to factor in unearned income, a topic one of our Tax Patriots can assist you in better understanding.

For more information as to whether you need to file or not, please contact a Tax Patriot for a FREE consultation and we will let you know whether or not you need to file or if you would like to find out for yourself, go here on the IRS website and answer the questions to see if you need to file or not.

*Married Filing Jointly is by far the WORST filing status and must be avoided at all costs! If you are considering this status you NEED to consult with a Tax Patriot to discuss potential alternatives.

[…] This post was mentioned on Twitter by jftaxservices, jftaxservices. jftaxservices said: Death and Taxes – Do I NEED To File A Tax Return This Year? http://bit.ly/evbxc0 […]

I chanced upon your internet site by a comment from another taxes site and I am joyful I did. Wonderful stuff you’ve got here…not sure if it’s a bug or not but the header looks a little out of sync in my Internet browser.

There were a few adjustments we made to the header and it should be fine now. I noticed that you have a tax software review site. I did not see anything about the type of returns done with the various software programs. From our professional experience the commercial grade software is okay for basic returns, however, anything more complicated requires the assistance of a tax professional.

How do we know? A majority of clients that come to see us with audit requests from the IRS did their own taxes.

[…] remained the same, however, the income thresholds have changed slightly. As stated in our article Death and Taxes – Do I Need To File A Return This Year? the standard deduction and exemption amounts from 2009 to 2010 remained virtually the same with the […]