We Need To See Some ID! How To Tell If Your Tax Preparer Is “Legit”

Now that the IRS has finally instituted the Preparer Tax Identification Number(PTIN) requirements for paid preparers it is our duty to make sure that you know how to designate between the different professionals out there who prepare and file income tax returns for pay. In addition, we will show you samples of what IRS issued identification looks like.

It’s hard to believe that before 1/1/11 ANYONE could prepare and file an income tax return and it was not just limited to the usual professionals such as a Certified Public Accountant(CPA), Enrolled Agent(EA), Enrolled Actuary or State Licensed Tax Attorney. All you had to do was sign a return, use your Social Security Number and viola, you’re in business as a paid income tax preparer. Despite this new requirement there will still be income tax preparation services that find a way to operate around this guideline. Unfortunately, at this time there is no database to lookup a PTIN to make sure it is valid. The best course of action is to check with the IRS, either on irs.gov or by calling them at 1-800-829-1040.

To check on the credentials of most tax return professionals you can try the following methods per IRS.gov:

- Enrolled agents, enrolled actuaries, and enrolled retirement plan agents can contact the IRS Office of Professional Responsibility at (202) 927-3397.

- Certified public accountants can find contact information for all state boards of accountancy at www.nasba.org.

- Attorneys can find contact information for all state bar associations at www.abanet.org.

In addition, we have found that some provisional PTIN preparers are confused as to what is an EA and a RTRP. I even asked a manager at a local store-front income tax service “Are you an Enrolled Agent?”. Her response “I have a license number, but I still need to take a test”. Well there are two tests, one which will be the minimum IRS requirement to become a RTRP and the more thorough examination to become an EA. Here’s the official distinction according to the IRS:

Is there a distinction between Enrolled Agents and Registered Tax Return Preparers? (posted 1/22/10)

Yes. The practice of enrolled agents before the IRS generally is not limited. The practice of Registered Tax Return Preparers is limited to preparing and signing tax returns for compensation and representing taxpayers before an Examination function of the IRS when the Registered Tax Return Preparer prepared the return under examination.

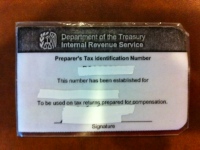

Here is what an IRS issued PTIN card looks like:

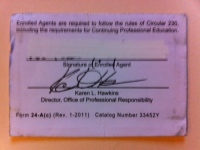

And an IRS issued Enrolled Agent(EA) card:

When it comes to tax professionals, the official stance of the IRS is:

“The IRS does not endorse any particular individual tax return preparer. For more information on tax return preparers go to IRS.gov.”

Go figure that they would have such a “politically correct” stance on this issue. The decision is yours, who would you trust the most to work on your taxes? A dedicated income tax professional such as an Enrolled Agent who focuses solely on income taxes and is required to take Continuing Professional Education(CPE) courses that are approved by the IRS OR a preparer who only abides by the minimum standards?

A great resource to look-up tax professionals is: TeaSpiller – Find An Accountant or Tax Pro